Why Invest in Real Estate Over 3-5% Yields CD-Money Market Accounts

A recurring question I have been receiving from investors runs along the lines of “Given that I can earn 3-5% returns in short-term money market and Certificate of Deposits (CDs), why should I consider real estate?” Before jumping into this question, it’s crucial to compare these investment options. In doing so, we can better understand their associated risks, returns, and unique benefits.

Understanding Passive Real Estate Syndication vs. CD/Money Market Accounts

Passive Real Estate Syndication: In this collaborative investment strategy, syndicators (e.g., Comfort Capital) consolidates funds from multiple investors to acquire and manage real estate assets. As a passive investor, you principally contribute capital, allowing the syndicator/operator to handle day-to-day operations.

CDs and Money Market Accounts (MMAs): CDs are fixed-term, fixed-return investments offered by financial institutions. MMAs, on the other hand, pay a higher interest rate than standard savings accounts while offering limited check-writing abilities.

Pros and Cons of Passive Real Estate Syndication:

Pros:

- Higher Return Potential: Real estate syndicators can outperform CDs and MMAs, thanks to property appreciation, rental income, and strategic property enhancements

- Passive Income Generation & Inflation Hedge: Passive investors enjoy a share of rental income, which can begin at 5% and potentially grow over time due to professional management, increased occupancy, and raised rental rates. Generally speaking, real estate investments can help hedge inflation due to operators’ ability to increase rents as prices rise

- Portfolio Diversification: Syndications broaden investment horizons beyond conventional stocks and bonds, mitigating overall investment risk

- Tax Benefits: Real estate syndications offer substantial tax benefits, including depreciation and potential deferral of capital gains tax via 1031 exchanges

Cons:

- Liquidity: Syndications cannot be easily liquidated, meaning investments may be locked in for several years

- Market Risk: High returns often entail higher risks. Market fluctuations can impact property values and rental income adversely

- Syndicator Dependence: The success of the investment relies heavily on the syndicator’s skills and management abilities

Pros and Cons of CD & Money Market Accounts (MMAs)

Pros:

- Security: Both CDs and MMAs are FDIC-insured, making them safe investment options

- Predictability: CDs provide fixed interest rates allowing certainty over the returns to be expected at the term’s end. MMAs fluctuate as interest rates adjust in the market

- Flexibility & Liquidity: CDs offer flexible terms, while MMAs provide easy access to your funds

Cons:

- Lower Returns: CDs and MMAs generally yield lower overall returns compared to investments like real estate syndications

- Withdrawal Limitations: Early withdrawals from CDs can lead to penalties, while MMAs limit certain types of withdrawals to six per month

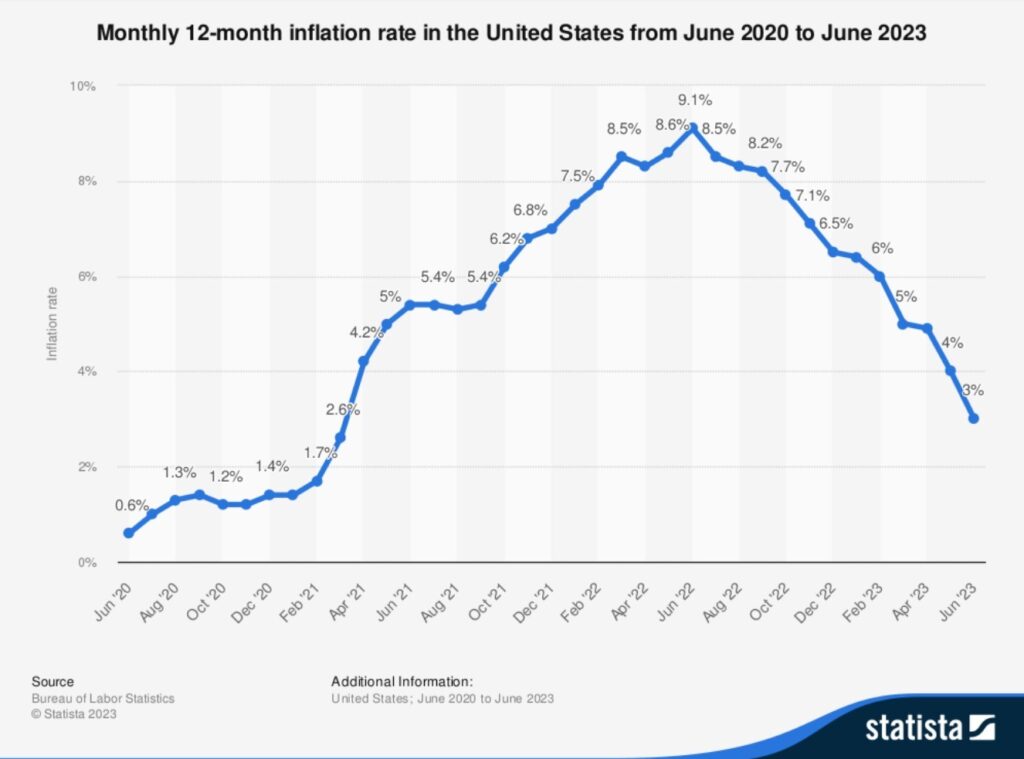

- Inflation & Interest Rate Risks: If inflation outpaces the interest rate of the CD, the purchasing power of returns may reduce. Over the last year, inflation has averaged 6%+ which has been generally greater than the rate offered by most CDs. For MMAs, a decrease in interest rates can diminish the rate of return paid on monies in the account. Inflation has cooled since hitting a peak of 9% in June 2022 (see graphic below). Assuming the Federal Reserve starts to reduce rates in the coming years, MMAs will start reducing the amount of interest paid and CDs will still be reducing the amount offered. In contrast, real estate valuations tend to appreciate as interest rates decline

While both passive real estate syndications and CDs/Money Market Accounts have merits, the choice boils down to your financial objectives, risk tolerance, and investment timeframe. With any investment, thorough research is key to aligning your choices with your financial goals. A diversified portfolio with a combination of both real estate and short-term CD/MMAs can make a lot of sense in an investor’s portfolio.

Disclosure: The information provided herein is for informational purposes only and does not constitute investment advice, endorsement, or a recommendation for any specific investment strategy or product. All investments carry a risk of loss, including the loss of principal. Before making any investment decisions, prospective investors should consult with their financial advisor, CPA, or other relevant professionals to evaluate individual circumstances and risks. It’s essential to conduct thorough due diligence and understand all potential risks before making any investment.